Interest Rates: Setting the Temperature of our Economic Climate

Picture this; on a hot summer’s night, you set your home’s thermostat to a cool 68°F before heading to bed. Upon waking, you realize that something is wrong; you’re drenched in sweat, and your room feels like an oven. You get up, and upon checking the news, find out that a heat wave touched down while you were asleep. Not only that, but you also forgot to shut a window, leaving your home’s central cooling unit to fight a losing battle against the powerful forces of nature (and forgetfulness!).

Financial markets operate in much the same way. The US Federal Reserve, also known as the Fed, has a dual mandate to maximize employment and maintain price stability. To achieve this, it has a number of tools at its disposal, the most prominent of which being its ability to adjust the target range for the Federal Funds Rate (commonly referred to as the “Fed Rate”). This rate range is what is referred to when it is said that the Fed is “cutting” or “raising” interest rates.

This approach to interest rate policy closely resembles a homeowner adjusting their thermostat in response to changing weather conditions.

When the economy begins to overheat (characterized by rapid growth and rising inflation), the Fed can raise its target interest rate, aiming to cool down and restore stability to markets. On the other hand, when the economy becomes too cold (indicated by increasing unemployment or slowed GDP growth), the Fed can lower its target interest rate in an attempt to spark greater economic activity.

Yet, just like with a thermostat, simply setting a desired temperature doesn’t guarantee the actual temperature will adjust quickly, or in the way you expect.

How did we get here?

To understand today’s interest rate environment, it’s helpful to revisit the key events and policy decisions that shaped the past several years. Central among these was the Covid-19 pandemic, an event that would set the stage for markets for years to come.

In February 2020, uncertainty surrounding the disease reached a tipping point as news of the virus’s rapid global spread dominated headlines. US Gross Domestic Product (GDP) fell at an annualized rate of 5.0% in Q1 2020¹, and unemployment spiked to nearly 15%² during the same quarter, a level not seen since the Great Depression.

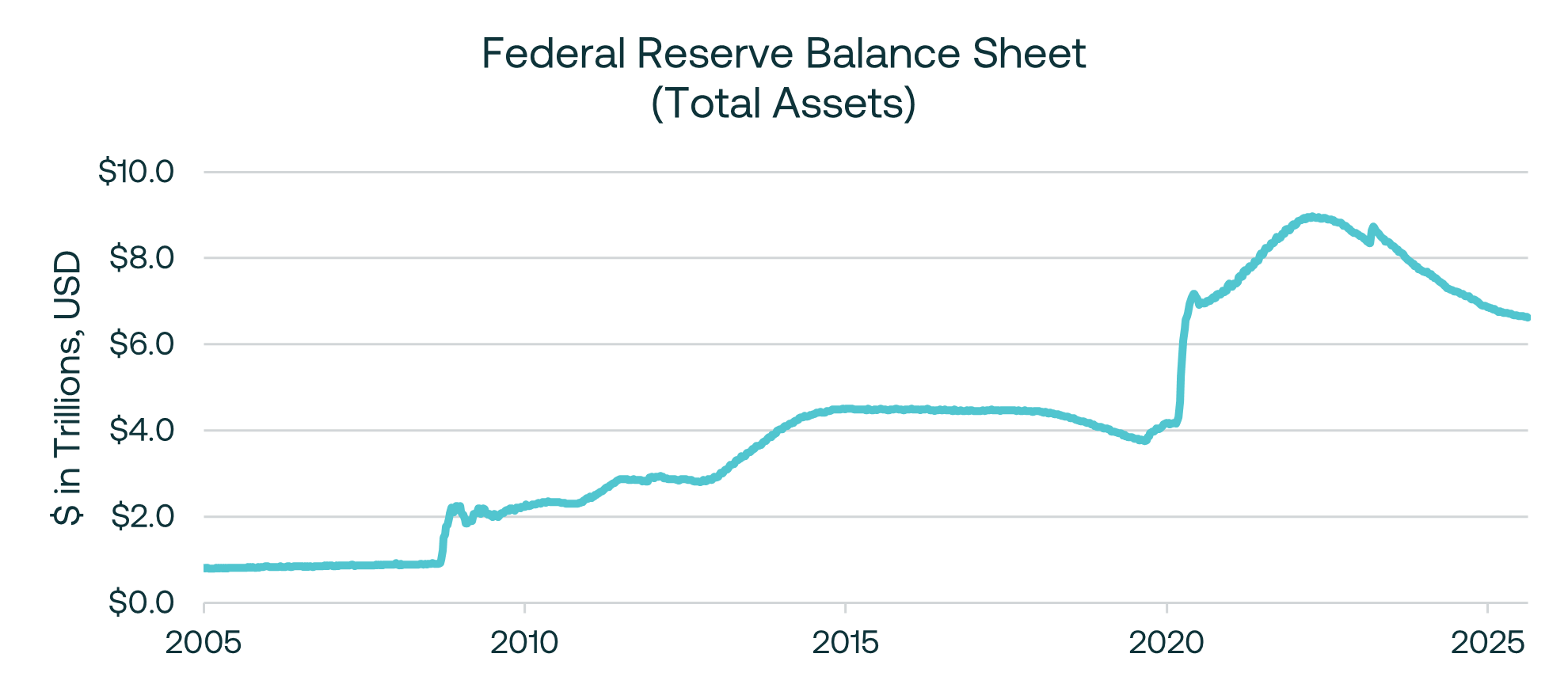

To combat this, the Fed acted quickly, bringing its target rate close to zero. In addition to this, it began rapidly purchasing financial assets such as US Treasuries and Mortgage-Backed Securities (MBS), injecting nearly $3T into the economy between Q1 and Q2 of 2020 alone. To further prop up the economy, the Fed continued its expansionary monetary policy into early 2022, bringing its balance sheet size to a whopping $8.9T at its peak in Q2 2022³.

Source: FRED

While this did provide momentary relief to markets, it created a brand-new problem. The economy began to quickly overheat, with inflation surging as the cost of goods and services climbed faster than consumers and businesses could keep up with.

The Fed, upon realizing this, once again changed its course, increasing its target rate over 5% within the span of a year. While this played a part in slowing economic growth and easing inflation, the damage had already been done. By the time rates reached their peak in July 2023, prices had already increased over 17% since early 2020⁴.

With interest rates elevated to their highest level since the Great Recession, the Federal Reserve sought to maintain economic balance, weighing the risks of slowing growth against the threat of renewed inflation and stressing the need for strong conviction before making any rate adjustments.

By late 2024, improving economic data prompted the Fed to begin gradually lowering rates, a move welcomed by investors and consumers who grew optimistic that an economic “soft landing” was finally within reach. That optimism, however, proved short-lived, as shifting economic data combined with new fiscal and trade policies forced the Fed to once again reevaluate its stance amid growing uncertainty.

What is going on with interest rates now?

This year has been dominated by two key initiatives from the current administration: the One Big Beautiful Bill Act (OBBBA) and the rollout of sweeping tariffs on foreign nations. While the true impact of these policies has yet to be fully understood, rising inflationary pressure is anticipated, driven by both a widening federal deficit⁵ ⁶ and price increases implemented by companies to offset higher import costs for goods and materials⁷.

Shifting expectations around future inflation have played a sizable role in the Fed’s policy decisions this year, leading it to adopt a “wait-and-see” approach informed by incoming economic data. As of August 2025, the Fed has yet to implement any additional rate cuts since its December 2024 policy decision.

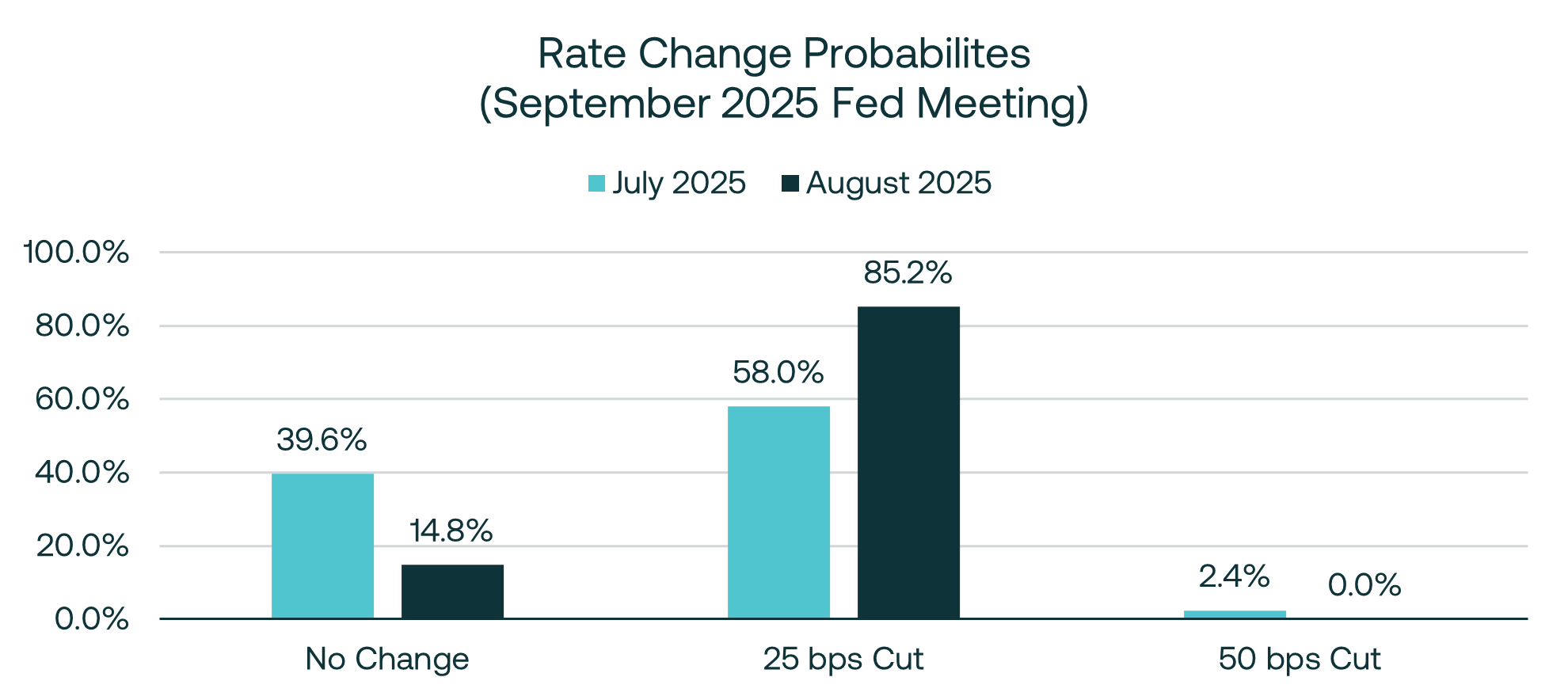

This month, new economic data was released, including an underwhelming jobs report which revised May and June estimates for job growth down sharply, and saw the unemployment rate rise to 4.2%⁸. As a result, expectations for a Fed rate cut in September rose sharply as investors looked to the Fed to stimulate economic activity through its monetary policy⁹.

Source: CME FedWatch Tool; Current Data as of 8/22/25

Does this mean cheaper borrowing costs are on the way?

Not necessarily.

Calling back on my earlier analogy, while the Fed has the authority to adjust its “thermostat” by changing its target rates, it is ultimately the market that determines the actual cost of lending & borrowing (the “true temperature” of the economy).

One of the most important indicators of this “temperature” is the yield on US Treasury securities, which acts as a benchmark for borrowing costs throughout the financial system—from mortgages to auto loans and beyond.

This is in part due to Treasuries’ role as near default-risk free securities, as all issuances are backed by the full faith and credit of the United States government.¹⁰ In other words, the only way that an investor would not receive an interest payment on a Treasury Bond would be if the US Government was unable to pay; and if this were to occur, there would be much bigger things to worry about than the rate on your auto loan.

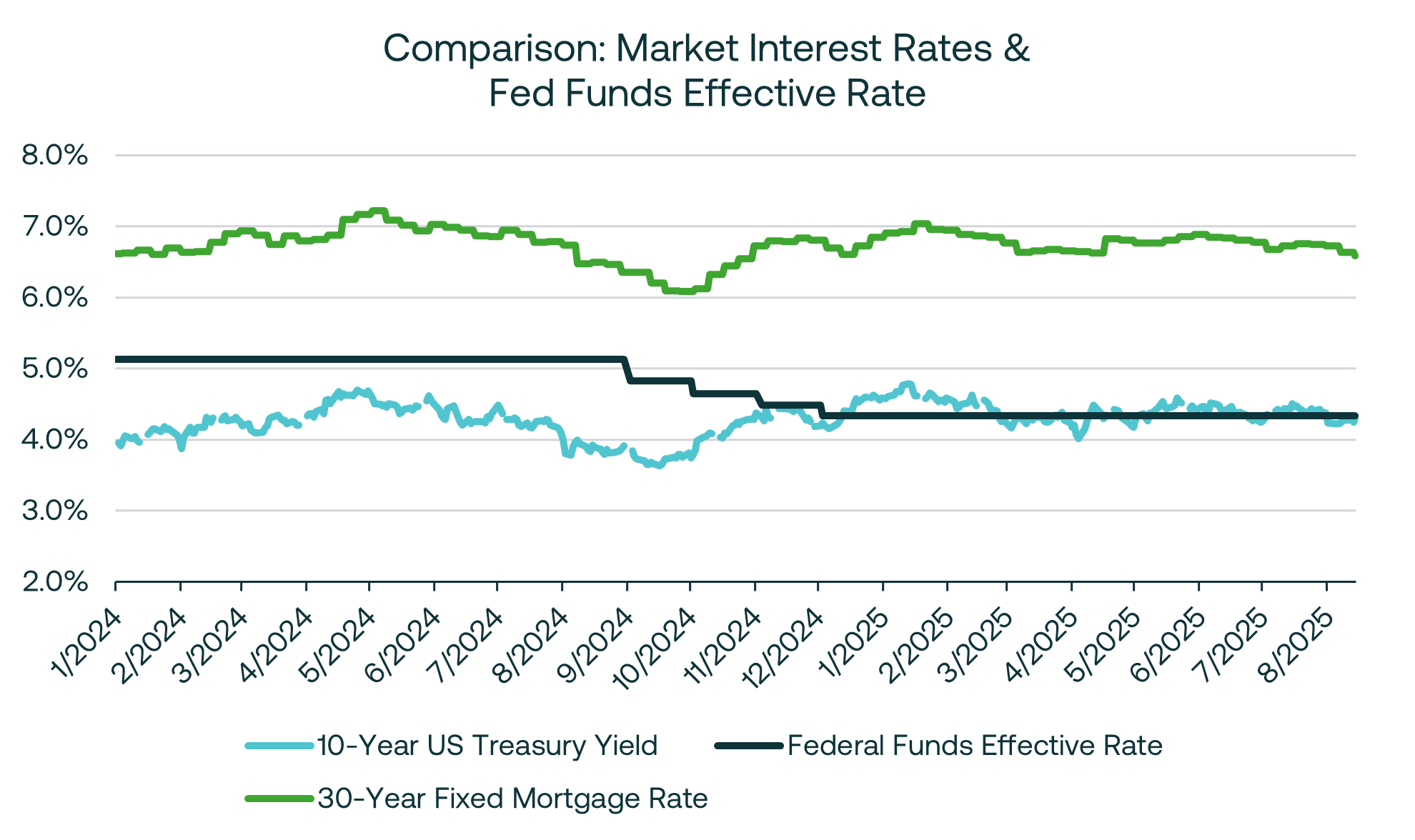

The chart below displays the change in the Federal Funds Rate, 10-Year US Treasury Yields, and 30-Year Fixed Mortgage Rates since the beginning of 2024. The market rates for 30-Year Fixed Mortgages and 10-Year US Treasuries move in near lockstep, separated by a spread (or “risk premium”) providing mortgages with a higher yield to compensate for higher inherent relative risk.

Source: FRED

In a vacuum, one might expect that as the Fed drops its rate, other market interest rates would simply follow suit. However, this is not always true, as was the case during the period of September 2024 to February 2025. Despite the Fed cutting rates multiple times over this period, market yields steadily rose, with Treasury yields increasing by nearly a full percent.

Why would Treasury yields deviate from Fed interest rates?

Unlike the Federal Funds Rate, which is determined by the Fed’s board of governors, Treasury yields are set by market forces such as investor demand, inflation expectations, and perceptions of economic growth. Here are just a few prominent trends impacting recent Treasury yield behavior.

Rising Debt and Credit Downgrades

US federal debt has soared to over $37T, surpassing 120% of GDP¹¹ and leading many to question if the US could reach critical mass and default on its obligations. In May 2025, Moody’s downgraded the government’s credit rating from Aaa to Aa1, representing the third downgrade by a major credit rating agency in just over a decade¹².

While the US defaulting on its debt is likely not a near-term concern, persistent uncertainty surrounding the creditworthiness of the US government has exerted upward pressure on yields, despite Treasuries being long been considered the “gold standard” of risk-free assets.

Treasury Auction Demand

The US Government regularly conducts auctions as a primary channel to offer Treasuries to investors for purchase. The level of demand from purchasers relative to issuances can help in determining yields, with higher demand equating to lower yields. The most recent 30-Year Treasury auction saw weak demand from bidders, including banks and foreign central banks, placing upward pressure on yields¹³.

Foreign Investment Trends

Foreign investment in US debt as a percentage of total ownership has fallen substantially over the past 10 years. This can be partially attributed to a rise in issuances to meet US spending needs which have outpaced foreign demand (which in itself creates rising pressure on interest rates), however, it also illustrates a broader trend that could contribute to a continued deviation between Treasury yields and the Fed Funds Rate.

Source: FRED

China was previously the largest foreign holder of US debt globally, possessing over $1.2T of securities in 2015¹⁴. The country has since divested over $500b of its US Treasury holdings, choosing instead to invest in alternative assets such as gold¹⁵.

Safe Haven Dynamics

US Treasuries have traditionally held the reputation of being a “safe haven” asset, with purchases increasing during times of economic uncertainty. In recent years, this status has come under scrutiny as public confidence in the US Government has waned and movements to reduce reliance on the US dollar (“de-dollarization”) have risen.

Additionally, bonds have shown heightened correlation with equities, calling to question their effectiveness in portfolio diversification¹⁶. Looking to the “Liberation Day” flash crash that followed President Trump’s April announcement of sweeping tariffs on foreign nations, the S&P 500 fell by over 10% in just two days¹⁷. While stock markets fell, Treasury prices also declined, pushing 10-Year yields up to a peak of 4.51% on 4/9/25¹⁸.

As confidence in US Treasuries and the US dollar has declined, alternative safe-haven assets such as gold and Bitcoin have seen significant inflows from investors seeking security and portfolio diversification. Consequently, both assets have experienced substantial growth in recent years, with gold trading around $3,400/oz and Bitcoin reaching a record high of $124,000 earlier this month.¹⁹

What does this mean for you and your portfolio?

While it is nearly impossible to predict exactly how interest rates will move next, there are steps that investors can take today to better position themselves for the future.

For those investing in fixed income, consider utilizing strategies such as bond ladders. This approach creates a portfolio of bonds that mature at regular, staggered intervals, allowing for reinvestment of proceeds as bonds mature. This can help portfolios generate a stable, predictable yield, and maintain flexibility across changing market conditions.

Investors should also consider thoughtful diversification across a variety of different assets when constructing a fixed income portfolio. True diversification means more than simply gathering a mix of positions and hoping for the best. It requires careful consideration of how individual positions contribute to portfolio volatility and their level of sensitivity to changes in interest rates.

Lastly, opportunities can be found across all market cycles, including during periods of elevated interest rates. In today’s environment, assets such as private credit have remained noteworthy, as they often provide yields above those available in public fixed income markets and can incorporate measures to help mitigate downside risk, such as requiring substantial collateral or including equity warrants.

It is our belief that successfully navigating today’s markets requires far more than passively waiting for the Fed to stabilize the economy. Achieving long-term success demands discipline, attention, and intentional decision-making, especially when dealing with an economic environment whose temperature seems to be in perpetual flux. By remaining proactive and purposeful, it is possible to build a portfolio equipped to withstand both today’s challenges and those of the future, establishing a strong foundation for long-term financial success.

Footnotes:

https://tradingeconomics.com/united-states/gdp-growth

https://fred.stlouisfed.org/series/UNRATE

https://fred.stlouisfed.org/series/WALCL

https://fred.stlouisfed.org/series/CPIAUCSL

https://budgetlab.yale.edu/research/inflationary-risks-rising-federal-deficits-and-debt

https://www.crfb.org/blogs/30-year-cost-obbba

https://www.frbsf.org/research-and-insights/publications/economic-letter/2025/05/effects-of-tariffs-on-inflation-and-production-costs/#toc_Conclusion

https://www.cnbc.com/2025/08/01/jobs-report-july-2025.html

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://treasurydirect.gov/marketable-securities/

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://ratings.moodys.com/ratings-news/443154

https://www.barrons.com/articles/treasury-30-year-bond-auction-yields-f32727f4

https://bipartisanpolicy.org/blog/foreign-investors-hold-a-shrinking-share-of-u-s-debt/

https://www.reuters.com/markets/asia/chinas-central-bank-extends-gold-purchases-ninth-straight-month-july-2025-08-07/

https://privatebank.barclays.com/insights/market-perspectives-march-2025-03-2025/where-next-for-the-equity-bond-correlation/

https://en.wikipedia.org/wiki/2025_stock_market_crash

https://www.reuters.com/markets/us/what-just-happened-us-treasury-market-2025-04-10/

Investing in commodities and digital assets involve risks including the loss of principal with the potential for periods of high price volatility.

Disclaimer: The discussion contained within is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Consult your tax professional before implementing any tax strategy. Nothing contained herein constitutes a solicitation, recommendation, or endorsement to buy or sell any token or security. Nothing herein constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or content herein before making any decisions based on such information or other content.

Past performance is no indication or guarantee of future performance. Investing involves risk including the potential loss of principal. Before investing, consider your investment objectives and Athos’ fees and expenses.

These materials do not constitute, or form part of, any offer to sell or issue interests in a Fund or any other entity. Any such offer or solicitation will be made solely by means of a definitive offering document, which will describe the actual terms of any securities offered and will contain material information regarding the securities. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein.