From Playroom to Portfolio: Collectibles as Alternative Assets

The toys gathering dust in your parents' attic might be worth more than your 401(k). LEGO sets have outperformed the stock market for over a decade, trading cards are now a $13 billion market, and designer toys are selling for six figures. What began as childhood entertainment has gradually gained attention as a potential alternative investment for some collectors.

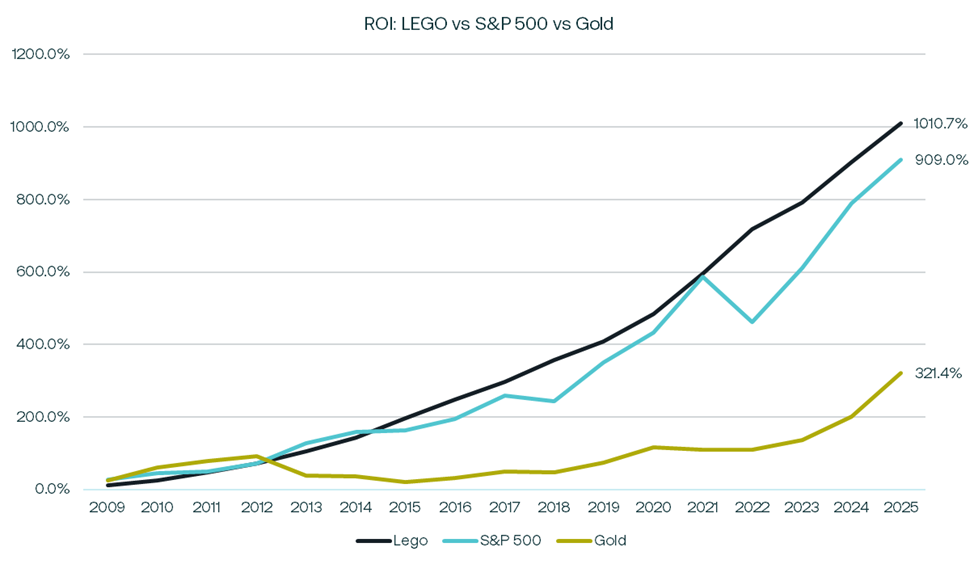

Illustration: ROI for Purchasing Every LEGO Set Released in 2009 vs. Investing Equivalent Funds in S&P 500 or Gold (2009–2025). Percentage return on investment from 2009 to 2025 for matched portfolios of LEGO, S&P 500, and gold. Source: Brickfact.com

LEGO’s impressive performance is part of a much bigger trend. The global collectibles market, spanning toys, trading cards, art, and more, reached nearly $295 billion in 2023—expected to grow to $488 billion by 2030 as interest explodes across age groups and regions. The numbers tell the story: while 57% of Baby Boomers consider collectibles interesting, 94% of Millennials and Gen Z actively research and engage with collectible markets as an investable asset class.

The Great Wealth Transfer Changes Everything

We're witnessing the largest intergenerational wealth transfer in history—$68 trillion flowing from Baby Boomers to Millennials and Gen Z over the next two decades. But this isn't just about money changing hands; it's about fundamentally different concepts of value.

While older generations see collectibles as toys, younger investors grew up with these items as integral parts of their cultural identity. For them, a first-edition Charizard card or limited-edition sneaker carries both nostalgic significance and verifiable scarcity. This difference isn't merely generational preference—it reflects how emotional attachment and cultural identity can amplify investment behavior, transforming collectibles into legitimate asset classes.

Three pillars exemplify how these forces underpin the cultural investment revolution:

Key Drivers in Contemporary Collecting:

LEGO: The Quiet Overachiever

LEGO's investment performance didn't happen by accident. The Danish company's discontinued sets created a perfect storm of investment characteristics: limited production runs, global brand recognition, and sustained cultural relevance across generations. Sets like the Taj Mahal or Millennium Falcon regularly sell for multiples of their original prices, with some rare pieces appreciating faster than growth stocks.

The key insight is that LEGO sets offer something stocks can't: the satisfaction of physical ownership combined with proven scarcity. When production ends on a popular set, that's it—no more will ever be made. Unlike companies that can issue more shares or split stocks, discontinued LEGO sets become genuinely finite assets. This scarcity, combined with nostalgic appeal, creates holding patterns that naturally drive up prices over time.

The brand transcends age groups and geographic boundaries, creating a collector base spanning eight-year-olds to octogenarians. This multi-generational appeal provides stability that many traditional investments lack, while the physical nature of the assets offers psychological comfort during market volatility.

Labubu: Global Cultural Arbitrage in Action

The meteoric rise of Labubu collectibles demonstrates how quickly cultural phenomena can create investment opportunities. These designer toys experienced 741% appreciation as they expanded from Asia to Western markets, but the behavioral dynamics reveal broader market trend.

Social proof—our tendency to follow others' behavior when uncertain—drives initial adoption. When early adopters in new markets see high valuations from established markets, it validates their decision to participate. FOMO then accelerates adoption as more people witness others profiting from cultural trends.

Social media amplifies these effects exponentially. Platforms create global communities of collectors who share unboxing videos, trade duplicates, and celebrate rare finds. This digital tribalism provides social validation for investment decisions that might seem irrational to outsiders but feel perfectly logical within the community context.

But hype can be fickle—if a new trend eclipses Labubu's appeal, those same blind-box dynamics can reverse, sending values lower almost as quickly as they rose.

Trading Cards: The Mature Alternative

The trading card market represents the most psychologically sophisticated segment of cultural investing, valued at $13 billion in 2024 and projected to reach $21 billion by 2034. Professional grading services like PSA and Beckett Grading Services have created objective measures for subjective value, while platforms like eBay provide transparent price discovery.

Both trading cards and designer toys like Labubu tap into a powerful behavioral driver: the thrill of discovery. A $5 trading card pack could contain a card worth $50,000, while a $15 Labubu blind box might hold a rare variant worth thousands. This lottery-ticket mindset doesn't just drive initial sales—it creates sustained demand as collectors chase that next big hit, generating consistent market activity that supports long-term price appreciation.

Yet even in this mature market, grading controversies and shifts in game popularity have triggered 30% price swings for top-grade cards within weeks.

The Early Access Economy: Learning from Taylor Swift

Understanding cultural investments requires recognizing how human psychology creates predictable market patterns. Consider what happened when Taylor Swift's Eras Tour tickets went on sale—a masterclass in behavioral economics in action.

Face-value tickets averaging $100–200 immediately resold for $1,311 on average, with premium seats reaching $30,000. This wasn't just supply and demand; it was multiple psychological forces converging simultaneously. Anchoring bias played a crucial role—once people saw others paying thousands, those prices became the new reference point for "reasonable." Social proof amplified demand as news coverage showed massive enthusiasm, making participation feel socially necessary.

Limited-edition releases are specifically designed to exploit this mental trigger through flash sales, countdown timers, and artificial scarcity—tactics that transform browsing into buying across every cultural market.

This dynamic extends throughout cultural markets with remarkable consistency. Limited-edition sneaker releases through Nike's SNKRS app operate on identical Consumer behavior. The $6 billion annual sneaker resale market demonstrates how early-access advantages create sustained arbitrage opportunities for those who understand crowd psychology.

These markets mirror sophisticated investment strategies while being psychologically accessible to retail participants. Unlike private equity, where complex financial models determine value, cultural markets reward understanding human behavior. Those who recognize when scarcity meets cultural significance can position themselves ahead of broader market recognition.

Technology-Driven Market Evolution

Consider how technology solved collectibles’ biggest barrier: trust. Back in the 1990s, industry experts estimated 30% of high-value trading cards in circulation were fake, but professional authentication and tamper-evident storage now keep fraud to under 2%. Heritage Auctions reports authentication disputes dropped from 15% to less than 1% in just eight years thanks to third-party grading and blockchain verification.

StockX has further revolutionized the space by introducing a real-time bid-ask marketplace, transparent pricing, and strict authentication processes, giving serious buyers and sellers institutional-grade confidence. Instead of relying on informal peer-to-peer transactions, today’s collectors benefit from standardized pricing, secure payment processing, and robust verification across luxury, sneaker, and collectibles markets.

Finally, widespread online forums and social platforms allow collectors to share information and track live trends, making pricing more efficient than ever before. Together, these advances have made collecting a modern, trusted, and data-driven marketplace.

What Does This Mean for Investors?

While most investors focus on broad-market index funds, a less conventional strategy quietly delivered surprising results. If someone had invested $12,444 buying one of every LEGO set released in 2011 and held them until today, the collection would now be worth around $76,319—an annualized IRR of 13.2%. Over the same period, the same investment in the S&P 500 would have grown to roughly $63,500, with a 12.4% IRR. This diversified “LEGO index” example isn’t meant to suggest collectibles should replace traditional assets, but it does illustrate how alternative investments can sometimes rival or even outperform the broader market.

However, collectibles carry unique risks: hype reversals, concentration risk, challenges in storage and resale, shifting popularity, and authenticity issues can all impact returns and liquidity. Diversification and caution remain essential, as today’s market leaders could lag in future cycles.

For those interested in diversifying beyond stocks and bonds, collectibles like LEGO offer food for thought—and a reminder that new asset classes sometimes emerge in unexpected places.

Note: Labubu is provided for information purposes only. There is no guarantee that other collectibles will have similar returns and substantially lower returns can occur including the loss of principal.

Sources:

Brickfact.com - LEGO investment returns (15.63% annual return 2011-2023)

BrickEconomy - 2011 LEGO set cost basis and current values ($12,444 to $76,319)

HSE University Study (Victoria Dobrynskaya) - 11% annual LEGO returns (1987-2015)

ScienceDirect/SSRN - Academic research on LEGO as investment asset

Heritage Auctions - Authentication dispute reduction (15% to <1%, 2015-2023)

Trading card market valuation - $13 billion (2024) to $21 billion (2034)

PSA/BGS - Professional grading services | Beckett Grading Services

Disclaimer: The discussion contained within is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Consult your tax professional before implementing any tax strategy. Nothing contained herein constitutes a solicitation, recommendation, or endorsement to buy or sell any token or security. Nothing herein constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or content herein before making any decisions based on such information or other content.

Past performance is no indication or guarantee of future performance. Investing involves risk including the potential loss of principal. Investing in collectibles comes with a relatively high level of risk. Before investing, consider your investment objectives and Athos’ fees and expenses.

These materials do not constitute, or form part of, any offer to sell or issue interests in a Fund or any other entity. Any such offer or solicitation will be made solely by means of a definitive offering document, which will describe the actual terms of any securities offered and will contain material information regarding the securities. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein.

Do you own any unique collectibles that are outperforming the public markets? Comment below to share your story and join the conversation.