Tariffs, Trade Tensions, and Global Markets:

What You Need to Know: How evolving policy risk is reshaping capital markets—and how we’re responding

Markets have now had a month to absorb one of the most aggressive trade pivots in modern history. Since April 2nd, the U.S. has enacted sweeping new tariffs, disrupting hundreds of billions in trade and triggering what’s been widely described as a full-blown tariff tantrum.¹ Even the most seasoned business leaders and institutional allocators are navigating in low visibility. Trade frameworks are shifting daily. Asset prices have become harder to interpret. And forward-looking decisions, including expansion, hiring, and capital deployment, are being put on hold. As Jean-Christophe Babin, CEO of an LVMH subsidiary, put it:

“What was true yesterday is no longer true today, what will be tomorrow I do not know.” ¹

This isn’t just noise; it is regulatory and geopolitical instability becoming a primary driver of markets. And understanding how markets are reacting is essential to understanding how portfolios should adapt.

A Deeper Problem: The Trade Deficit and the Limits of Tariffs

The United States has run a persistent trade deficit since the 1970s—importing far more than it exports. In 2023, that deficit reached over $773 billion,² driven by demand for low-cost foreign goods and a deeply embedded global supply chain model. This imbalance is fueled by large fiscal and current account deficits—both increasingly financed by foreign investors, raising the stakes of potential retaliation. This external dependence raises new risks, especially as trade relationships fray. Exhibit 1 illustrates this growing imbalance.

Exhibit 1: Foreign ownership of U.S. assets is a critical offset to persistent deficits—but this dependence raises the stakes of trade retaliation.

Data as of January 31, 2025. Source: U.S. Bureau of Economic Analysis, Haver Analytics.

Tariffs are often sold as a quick fix: tax imports, discourage consumption, revive domestic manufacturing, and shrink the deficit. But that theory is rarely borne out in practice.

Tariffs may provide short-term tailwinds to a handful of industries, but the broader economic costs can be steep. Input prices rise. Consumers pay more. U.S. exporters face retaliatory barriers. And global capital flows reroute—not to resolve the imbalance, but to sidestep the friction. In many cases, the trade deficit isn’t reduced, it’s simply reorganized, with imports redirected from one country to another.

Exhibit 2 underscores the magnitude of this shift: based on current policy, the U.S. effective tariff rate is now projected to exceed 25%—more than seven times the post-WWII average.³ It represents the most aggressive tariff stance in modern economic history, aimed at addressing deep structural imbalances with increasingly blunt tools.

Exhibit 2: Projected tariff policy would push the U.S. effective tariff rate to levels more than 7x the average of the globalized era.

Source: World Bank, WITS (World Integrated Trade Solution). *Trade-weighted; **Customs duties collected divided by total goods imports.

To see how these effects play out in practice, the 2018 washing machine and steel tariffs offer a useful lens into the short-term benefits, and longer-term consequences, of this policy approach.

Case Study: 2018 Washing Machine & Metal Tariffs and Their Aftermath

In early 2018, the U.S. imposed tariffs on imported washing machines, steel, and aluminum to shield domestic manufacturers. The outcome was immediate:

· Prices rose: Washer prices jumped ~12% within a year. Dryers, though untariffed, saw similar increases as companies raised bundle pricing (see Exhibit 3).

· Consumers paid the price: The policy cost U.S. households an estimated $1.5 billion annually—roughly $815,000 per job created.

· Jobs were added: About 1,800 jobs came from manufacturers like Samsung and LG building U.S. plants.

· Tariff revenue totaled $82 million: Only a fraction of the consumer cost.

· Ripple effects hit other sectors: Simultaneous tariffs on steel and aluminum raised input costs, contributing to broader job losses estimated at 142,000 across impacted industries.

The lesson? Tariffs can boost targeted sectors in the short run—but often at a far greater cost to consumers and the broader economy.⁴

Exhibit 3: Tariffs on washers triggered broad price increases across both domestic and imported appliances—costs largely passed to the consumer.

Source: Flaaen Et Al., “Price Effects of U.S. Trade Policy”

How Markets Have Responded

Since April 2nd, trade policy has shifted from strategic to sweeping. What began as sector-specific protection has become a broader effort to realign trade relationships—with China, but also with allies—through rapid-fire policy decisions, retaliatory moves, and a breakdown of long-standing norms.⁵

The result? Uncertainty—and with it, volatility.

Business planning has stalled. When the rules of trade are unknowable, companies pull back on investment and delay hiring, and markets, which rely on clarity to price risk, respond with turbulence. Equity volatility has surged, particularly in globally exposed sectors like manufacturing, technology, and consumer goods. Fixed income markets have whipsawed between traditional safe havens like U.S. Treasuries and alternatives like bunds and gold, as investors reassess both inflation risk and geopolitical exposure.

Markets are no longer responding solely to economic fundamentals. They are increasingly driven by policy uncertainty. Exhibit 4 illustrates how trade-related shocks are being priced into equities, credit spreads, and other asset classes.

Exhibit 4: As trade policy uncertainty rises, so does volatility—affecting equities, credit spreads, and global performance across asset classes.

Data as of April 30, 2025 Source: Economic Policy Uncertainty, Cboe, Federal Reserve Bank of St. Louis, MSCI.

Today’s asset pricing isn’t just about fundamentals—it reflects mounting policy friction. And while markets are efficient, they’re not clairvoyant. In this type of environment, even disciplined investors can feel disoriented.

Still, over the long run, markets tend to re-anchor around outcomes. We expect capital to flow toward companies and regions that prove adaptable—those with resilient supply chains, trade flexibility, and a lower sensitivity to regulatory shock.

Strategic Considerations

Periods like this demand not only patience—but precision. As Nobel laureate Harry Markowitz put it, “diversification is the only free lunch in investing.”⁶ But true diversification goes beyond spreading assets across sectors. It means building portfolios that are designed to hold up under stress, while still capturing long-term opportunity.

At Athos, we believe the best responses to uncertainty start long before the headlines hit. By designing resilient portfolios from the outset, we create the flexibility to respond with purpose, not panic. Today, that means making tactical adjustments within a long-term framework. We are not shifting risk targets—but we are actively positioning portfolios for the path ahead. This includes:

· Harvesting losses selectively to enhance tax efficiency.

· Reallocating toward assets that tend to perform in stagflationary environments—such as higher-quality high yield bonds and real assets.

· Reassessing geographic exposure, particularly to economies caught in the crossfire of global trade tensions.

Our emphasis on private investments remains a core differentiator for how we build resilient portfolios. These assets, across private credit, real assets, and private equity, offer:

· Low correlation to public markets, offering more robust diversification when volatility spikes.

· Exposure to long-term structural trends without the noise of daily market sentiment.

· Enhanced return potential through access to illiquidity premiums and underpriced risk.⁷

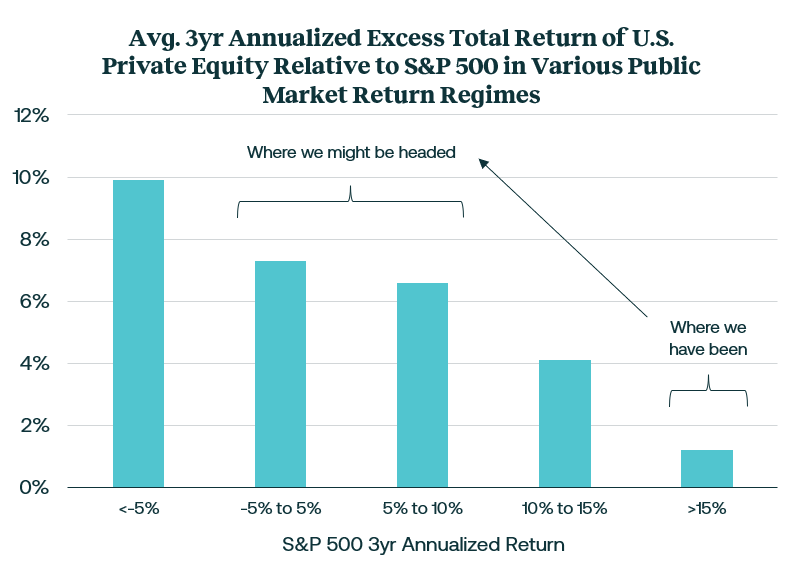

This dynamic is especially relevant in today’s environment. As Exhibit 5 illustrates, U.S. private equity has historically outperformed the S&P 500 on a 3 year annualized return, and by an even more dramatic margin when public markets return less than 10% annually—a range many expect going forward. This “illiquidity premium” isn’t just theoretical; it has delivered real, repeatable excess returns over time.

Exhibit 5: Private equity historically delivers outsized returns when public markets lag—driven by long-term value creation and the illiquidity premium.

Data as of Q1 1989 through Q3 2024. Source: S&P 500, Cambridge Associates U.S. Private Equity, Bloomberg

Disclaimer: There is no guarantee that such hypothetical returns would be achieved. There are risks and uncertainties related to hypothetical returns.

For more on how we think about private markets as a long-term growth engine, read Athos' recent article on private investing.

Final Thoughts

Volatility, especially when driven by policy unpredictability, can feel destabilizing. But with the right investment framework—one grounded in global perspective, asset class flexibility, and a disciplined approach—uncertainty becomes something to navigate, not fear.

Staying invested doesn’t mean standing still. It means staying informed, intentional, and aligned with what markets are truly telling us.

Volatility may be inevitable. Resilience is built.

If you’d like to discuss how these themes may impact your portfolio or explore how we’re positioning for the path ahead, our team is always available to help.

Sources:

1. Reuters – Trump’s trade war hits stocks again

2. Trade Deficit – Bureau of Economic Analysis

3. World Bank, WITS & Fitch Ratings – U.S. Effective Tariff Rate

4. AEA – Flaaen, Hortacsu & Tintelnot (2019) & Wharton Budget Model – Economic Effects of President Trump’s Tariffs

5. Peterson Institute - Trade War Timeline & Atlantic Council - Tariff Tracker

6. Markowitz, H. M. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77–91. & Markowitz, H. M. (1959). Portfolio Selection: Efficient Diversification of Investments. New York: John Wiley & Sons.

Zach SchelinFor more information contact us at info@athoswealth.com